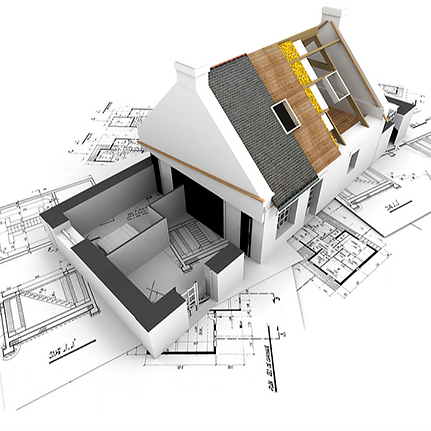

Start to Finish Insurance Claim Management

Emergency Insurance Claims Service

All Claims Handled to ensure maximum insurance payout

Domestic & Commerical Property Claims

Please fill out the enquiry form below and we will be in touch to assist you

.png)

Eden Claims Management LTD

Eden Claims is a fully regulated Claims Management firm that specialises in offering a seamless, stress-free solution for both domestic and commercial property claims. No matter the size or complexity of your claim, our expert team is here to assist. We manage direct negotiations with your insurance provider, from start to finish ensuring that your interests are represented every step of the way.

With offices strategically located in Dublin and Offaly, Eden Claims provides a comprehensive Nationwide service. Our highly skilled and experienced loss assessors work diligently to ensure your claim is handled swiftly and professionally. We pride ourselves on obtaining the most favourable settlement possible for our clients, relieving the burden that often comes with property damage claims

Decades of Industry Experience

Though Eden Claims Management Ltd was officially established in 2010, our Managing Director, Trevor Ryan, has been a leading figure in the claims management and loss assessing sector for many years prior to establishment of Eden Claims Management. Trevor's extensive experience in both the insurance and constructions industry for over 30 years, coupled with a deep understanding of the challenges the claimants face, inspired the creation of Eden Claims. His vision was to build a company that would address the shortcomings prevalent in both insurance companies and other loss assessing firms, ensuring a higher standard of service and support for clients to ensure clients come first in the process.

At Eden Claims, we are committed to processing your claim as efficiently as possible, with a focus on securing the best outcome. By acting on your behalf and dealing directly with your insurer, we eliminate the stress and confusion that often accompany the claims process. Whether it's a minor domestic claim or a large-scale commercial loss, you can trust our team to manage every detail with expertise and care.

Why Choose Eden Claims?

We manage the entire claims process on your behalf, from start to finish, allowing you to focus on what matters most.

Hassle-Free Process:

OUR SERVICES

Struggling with water damage? Eden Claims specializes in water damage management, helping homeowners get quick solutions and maximum compensation for repairs (burst pipe in attic, burst tank in attic, bursts in copper cylinder, bathroom leaks, leak from behind or beneath your kitchen, water stains on your ceilings and walls).

Water Damage Claim

Insurance claims can be an insufferable and tedious process. Due to our strong, long-term relationships with insurance companies, we will handle your insurance claim for you from start to finish, guaranteeing you the maximum payout for your unique circumstances.

Claims Management Services

IS YOUR HOME INSURED CORRECTLY?

It is your responsibility to ensure your home has the correct rebuild cost. The SCSI web page can assist with this, as you can see from the link there are different areas of the country with different costs per square metre. If you have a claim on your property and your home is underinsured by 20% your claims will be reduced by the same percentage.

So if your claim is for €10,000 and your home is underinsured by 20% the amount you will receive will be €8,000.

Please click the link below and review your home rebuild cost, you will find your existing rebuild costs on your insurance schedule.

Eden Claims provides a seamless, start-to-finish property insurance claims management service that alleviates the burdens of managing claims independently.

Due to our long-standing, strong relationships with insurance companies and brokers, we simplify the insurance claim process, maximising the settlement value to ensure you receive the compensation you deserve.